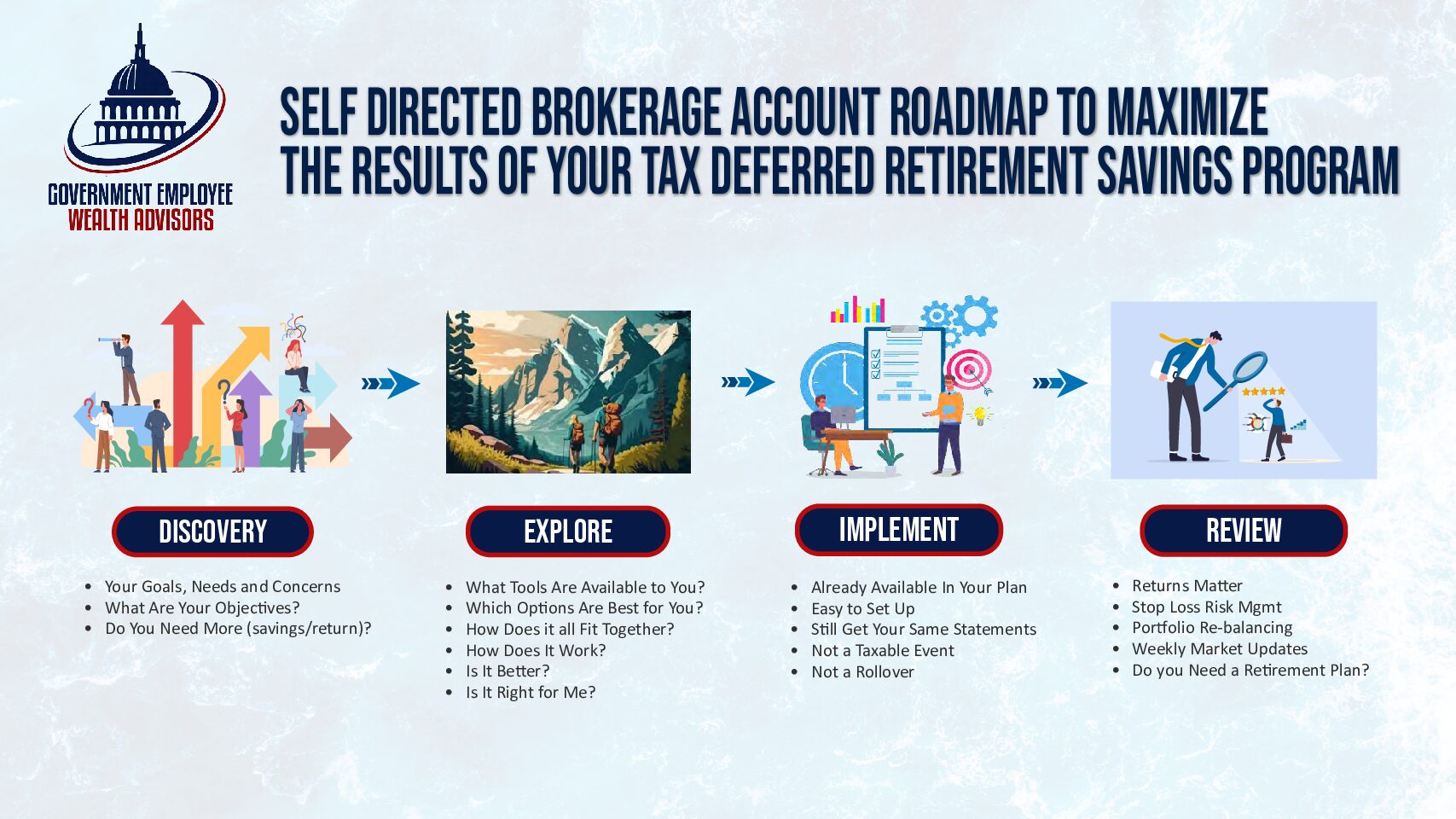

Rather than just wait around hoping that the standard investment choices inside your workplace retirement account grow—whether you have a 401(a), 401(b), 457(b), TSP, 401(k), or 403(b)—did you know that a financial advisor can actually manage the investments inside your retirement account without the need to change your provider?

Professionally Managed Retirement Accounts

With an Advisor, and Without an Advisor

In fact, studies show that professionally managed accounts can outperform unmanaged accounts by 3.32%, net of fees. For a 45-year-old participant, this could translate to 75% more wealth at age 65! At Government Employee Wealth Advisors, we created the SBDA Program to help you maximize your retirement.

Let’s Talk About Your Account! It’s Easy to Get Started

You do not have to move money out of your existing plan! Your online access will stay the same, your statements will look the same, and your account numbers will stay the same. You will just have more investment options—often better-performing options! Book some time with us to see if we can get you to an earlier retirement!

What You Need to Know: Participation Requirements

To participate in the SDBA, you must:

- Maintain a minimum balance of $5,000 in the Investment Plan’s primary investment funds.

- Make initial and subsequent transfers into the SDBA of at least $1,000.

- Pay all trading fees, commissions, administrative fees, and any other expenses associated with participating in the SDBA.

Investment Options

Available SDBA investment options include the following:

- Stocks listed on a Securities Exchange Commission (SEC) regulated national exchange

- Exchange-Traded Funds (except for leveraged Exchange-Traded Funds)

- Mutual funds (except for any of the Investment Plan’s primary investment funds)

- Fixed income products

Not Permitted

Investment options not permitted within the SDBA include the following:

- Illiquid investments

- Over-the-Counter (OTC) Bulletin Board securities

- Pink Sheet securities

- Leveraged Exchange-Traded Funds

- Direct Ownership of Foreign Securities

- Derivatives, including, but not limited to, futures and options contracts on securities, market indexes, and commodities

- Limited Partnerships

- Private Placements

- Buying or Trading on Margin

- Investment Plan primary investment funds

- Any investment that would jeopardize the Investment Plan’s tax-qualified status

Account Statements

You will continue to receive a quarterly statement from the Investment Plan, and your SDBA total balance will be reflected on this statement. You will also receive a separate brokerage statement detailing your SDBA balances, holdings, and activity. If any activity occurs in your SDBA, you will receive a monthly statement. If there is no activity in your SDBA, you will receive a quarterly statement. You will also receive a trade confirmation for any purchases or liquidations in your SDBA.

THE SDBA PROGRAM: Brought to You by Government Employee Wealth Advisors

The SDBA Program is for experienced investors who want the flexibility to invest in a variety of options beyond those available in their current retirement plan’s primary investment funds. It is not suitable for everyone and there are risks associated with the investments in the SDBA Program, just like there are risks in your current workplace plan’s funds.

Get Professional Retirement Advice

From Financial Advisors with Government Benefits Experience

It is important to choose an experienced financial advisor you trust to choose investments prudently based on your individual risk tolerance, personal financial situation and time horizon to retirement. At Government Employee Wealth Advisors, we are independent advisors with access to many different types of investments through our sister company, Nautica.

We are one of the few financial advisory firms whose primary focus is on retirement income distribution – not accumulation – and we have been working with government employees to help them maximize their benefits for decades. When it comes to retirement income, there are actually a lot more decisions to be made than there are while you’re growing your assets!

SEND US A MESSAGE

The information provided herein is the exclusive property of Government Employee Wealth Advisors, a DBA of Nautica Asset Management LLC. This material has been prepared for educational purposes only. It is not intended to provide nor should be relied upon for accounting, legal, tax, or investment advice.

Helping government employees choose benefits, improve their financial futures, and retire successfully.

480 N Canton Center Rd. #87919 • Canton, MI 48188 • Phone: (734) 794-3885